Loading

Get Oh Stec Mpu 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH STEC MPU online

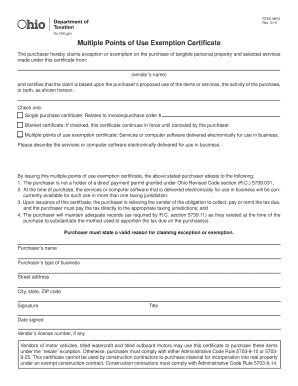

Filling out the OH STEC MPU, or Multiple Points of Use Exemption Certificate, online is a straightforward process that helps purchasers claim exemptions on certain purchases. This guide provides detailed instructions on how to accurately complete each section of the form.

Follow the steps to successfully complete the OH STEC MPU online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the vendor’s name in the designated field. This identifies the vendor from whom the tangible personal property or selected services are being purchased.

- Check the appropriate box for the type of exemption being claimed: 'Single purchase certificate,' 'Blanket certificate,' or 'Multiple points of use exemption certificate.' This will define the scope of your exemption.

- For the 'Multiple points of use exemption certificate,' describe the services or computer software that is delivered electronically for use in business. Be specific in your description.

- In the purchaser's name field, enter your full name or the name of the business making the claim.

- Indicate the type of business by selecting the appropriate option provided.

- Fill in your complete street address, including city, state, and ZIP code, to ensure correct identification.

- Sign the document in the designated area to attest that the claims made are accurate and valid.

- Include your title in the provided field to clarify your position within the organization, if applicable.

- Date the form by entering the correct date of signing.

- If applicable, include the vendor’s license number to assist in processing the exemption.

- Review all fields for accuracy, then save the changes, download, print, or share the form as necessary.

Complete your OH STEC MPU online now to ensure a smooth transaction.

Related links form

If a manufacturer uses tangible personal property primarily in its manufacturing, the tangible personal property is exempt from sales and use tax. Manufacturers are also responsible for paying sales and use tax on the taxable services used in its busi ness.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.