Loading

Get Hhs Omb 0970-0166_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HHS OMB 0970-0166_DSA online

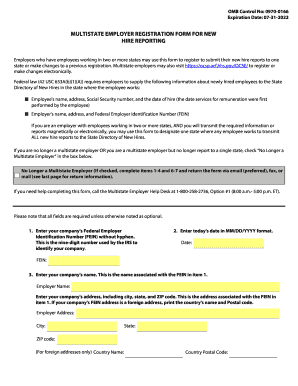

The HHS OMB 0970-0166_DSA form is essential for multistate employers to report new hire information to a designated state. This guide provides step-by-step instructions to help users accurately complete the form online, ensuring compliance with federal requirements.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to obtain the form and open it for editing. This will enable you to fill in your information accurately.

- Begin by entering your company's Federal Employer Identification Number (FEIN), ensuring not to include any hyphens. This unique nine-digit number is used by the IRS to identify your company.

- Next, fill in today's date in the MM/DD/YYYY format to signify when the form is completed.

- Enter your company's name as it appears with the FEIN. This identifies your organization for reporting purposes.

- Complete the section for your company's address, including city, state, and ZIP code. If the address is international, specify the country name and postal code.

- If your company has subsidiaries, refer to the Multiple FEIN Spreadsheet and enter the requested information about each subsidiary.

- Indicate the state or U.S. territory designated for reporting new hire information. Ensure that this state is one where your employees work.

- Select additional states or U.S. territories where your company has employees, ensuring at least one option is chosen aside from the designated state.

- Provide your name, title, work phone number, work email address, and an optional work fax number to facilitate communication.

- Finally, sign the form to certify that the information provided is accurate and that you are authorized to complete the form on behalf of your company.

- Once the form is completed, you can save changes, download, print, or share it as necessary.

Complete your form online today to ensure compliance and streamline your reporting process.

WITHHOLDING LIMIT The amount withheld for support may not exceed fifty percent (50%) of the employee's/income recipient's net wages or other income. (T.C.A. § 36-5-501(a)(1)) It is the employer's responsibility to determine when the 50% level is met.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.