Loading

Get Withholding Tax Faqs - Division Of Revenue - Delaware

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding Tax FAQs - Division Of Revenue - Delaware online

Filling out the Withholding Tax FAQs - Division Of Revenue - Delaware is an important step for ensuring compliance with state tax regulations. This guide provides detailed instructions to help users confidently complete the form online.

Follow the steps to successfully fill out the form.

- Click ‘Get Form’ button to obtain the necessary form and access it in an editable format.

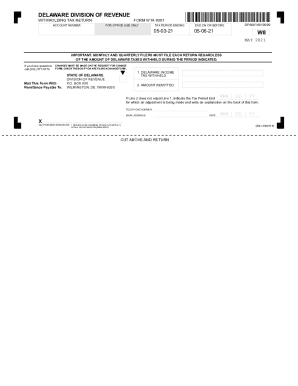

- Begin by entering your account number in the provided field. This unique identifier is crucial for processing your return accurately.

- Specify the tax period ending by filling in the date accurately. This should reflect the period for which you are reporting withholding tax.

- Indicate the total Delaware income tax withheld during the period in the designated section labeled 'Delaware income tax withheld'.

- Provide the amount you are remitting on the next line, labeled 'Amount remitted'. Ensure this matches the amount reported in the previous step.

- If the amount remitted does not equal the income tax withheld, indicate the tax period for which an adjustment is being made and include an explanation on the back of the form.

- Include your contact information by entering your telephone number and email address to facilitate any necessary communication regarding your submission.

- An authorized person should sign and date the form, acknowledging that the information provided is accurate under penalty of perjury.

- After completing all fields, ensure to save your changes. You may also choose to download, print, or share the completed form as required.

Complete your withholding tax return online today to ensure timely compliance.

Related links form

Your federal income tax withholding from your pay depends on: The filing status shown on your W-4 form. The number of dependents or allowances specified, and. Other income and adjustments on the Form W-4 you filed with your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.