Loading

Get Me 941p-me 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

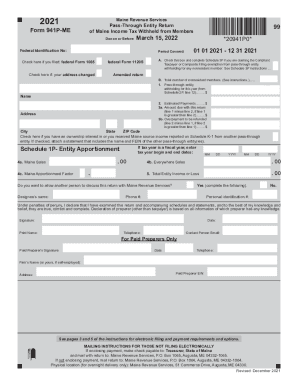

How to fill out the ME 941P-ME online

Filling out the ME 941P-ME online can seem daunting, but with the right guidance, you can navigate the form with ease. This step-by-step guide will help you understand each section and fill it out accurately.

Follow the steps to ensure accurate completion of the form.

- Click ‘Get Form’ button to access the ME 941P-ME form and open it in your preferred online editor.

- Begin by entering your Federal Identification Number in the designated field. This number is essential for processing your tax return.

- Indicate the period covered by checking the appropriate dates. Ensure that these dates reflect your tax year accurately.

- If you filed federal Form 1065 or Form 1120S, check the corresponding box.

- If there's been a change in your address, mark the box provided for that purpose.

- For amended returns, check the appropriate box to indicate that this is an adjustment.

- Complete Section A if you are claiming the Compliant Taxpayer or Composite Filing exemption from pass-through entity withholding. Attach Schedule 3P as instructed.

- Fill out the total number of nonresident members and the pass-through entity withholding for the year, as well as any estimated payments made.

- Calculate the amount due with this return by subtracting estimated payments from the total withholding or identify any overpayments to be refunded.

- Provide your contact information, including your name, address, city, state, and ZIP code. If you have income reported from another pass-through entity, mark the box and attach the required statement.

- Complete Schedule 1P for details about Maine sales and apportionment factors.

- If applicable, provide designees’ information to allow them to discuss this return with Maine Revenue Services.

- Declare under penalties of perjury that the information provided is accurate and complete, then sign and date the form.

- Review all entries for accuracy before finalizing. You can then save changes, download a copy, print, or share the completed form as necessary.

Take the next step in managing your tax obligations by completing the ME 941P-ME online today.

A pass-through entity having Maine-source income may file a composite income tax return for all of its eligible nonresident individual members who agree to participate. If a nonresident member participates in the composite return, an individual income tax return is not required from that member.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.