Loading

Get Ok Form Ow-8-p-sup-i 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK Form OW-8-P-SUP-I online

Filling out the OK Form OW-8-P-SUP-I online can be straightforward with the right guidance. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to easily complete the OK Form OW-8-P-SUP-I online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your name as shown on your return in the designated field. This information is important for identification purposes.

- Next, provide your social security number (SSN) in the appropriate field. Ensure that the number is entered correctly to avoid delays.

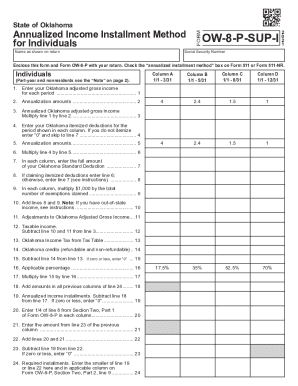

- In Column A, enter your Oklahoma adjusted gross income for the period from January 1 to March 31. Continue this for each respective column, reflecting the income for the corresponding periods.

- Complete the lines for annualization amounts, matching the specified rates for each column. These values will assist in calculating your annualized Oklahoma adjusted gross income.

- Enter your Oklahoma itemized deductions for the periods shown in each column. If you do not have itemized deductions, input '0' and move to line 7.

- Multiply your line 4 by line 5, and enter the result on line 6 for each respective column.

- Input the Oklahoma standard deduction for each column on line 7, if claiming it.

- On line 8, if claiming itemized deductions, enter the result from line 6; if not, enter the value from line 7.

- Calculate line 10 by adding lines 8 and 9, making sure to account for any necessary adjustments or out-of-state income as instructed.

- Move on to line 11 to include any applicable adjustments to your Oklahoma adjusted gross income. Use this to deduce your taxable income.

- On line 12, subtract the amounts in lines 10 and 11 from line 3 to find your taxable income.

- Utilize the tax table to enter the Oklahoma income tax amount on line 13.

- Summarize any Oklahoma credits on line 14, ensuring not to annualize any credits.

- Subtract line 14 from line 13 for line 15. If this results in zero or less, enter '0'.

- Input the appropriate applicable percentage from the provided options on line 16.

- Multiply the value on line 15 by line 16 for line 17.

- Add the amounts in all previous columns of line 24 and enter them on line 18.

- For line 19, subtract line 18 from line 17. If the result is zero or less, enter '0'.

- Enter one-fourth of line 8 from Section Two, Part 1 of Form OW-8-P in each column on line 20.

- Transfer the amount from line 23 of the previous column to line 21.

- Add lines 20 and 21 for line 22.

- On line 23, subtract line 19 from line 22. If the result is zero or less, enter '0'.

- For line 24, enter the smaller amount of line 19 or line 22. This amount should be reported in the appropriate section of Form OW-8-P.

- Once completed, you can save your changes, download the form, print it, or share it as needed.

Complete your OK Form OW-8-P-SUP-I online today for a seamless filing experience.

Simply call (405) 521-3160 or in-state toll free (800) 522-8165, extension 13160 and select the option to "Check the status of an income tax refund". By providing your Social Security Number and amount of your refund, the system will provide you with the status of your Oklahome tax refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.