Loading

Get Ms Dor 80-315 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR 80-315 online

The MS DoR 80-315 form is essential for claiming the reforestation tax credit in Mississippi. This guide provides a clear and supportive walkthrough to help users complete the form online accurately and effectively.

Follow the steps to fill out the MS DoR 80-315 online easily.

- Press the ‘Get Form’ button to access and open the MS DoR 80-315 form in an online platform for editing.

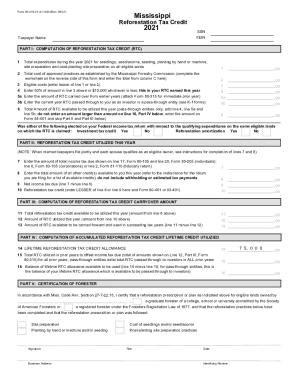

- Begin with Part I, where you will compute your reforestation tax credit. Line 1 requires you to enter the total expenditures during 2021 for all eligible reforestation activities. Make sure to include all applicable costs.

- On line 2, input the total cost of approved practices as established by the Mississippi Forestry Commission based on the worksheet from the reverse side.

- Line 3 should reflect the lesser of the amounts from line 1 or line 2; enter this figure for your eligible costs.

- For line 4, calculate 50% of the amount entered in line 3 or $10,000, whichever is less, as this represents the reforestation tax credit earned this year.

- In line 5a, include any reforestation tax credit carried over from prior years, ensuring you attach Form 80-315 for the immediate prior year.

- On line 5b, enter any current year tax credit passed through to you as an investor in a pass-through entity, using your K-1 forms for reference.

- Summarize the total available tax credit for the current year in line 6 by adding line 4, line 5a, and line 5b. Ensure this amount does not exceed the figure on line 16 of Part IV.

- Confirm on the form whether investment tax credit or reforestation amortization was elected on your Federal income tax return.

- Continue to Part II, where you will enter information regarding the reforestation tax credit utilized this year starting with lines 7 and 8.

- Calculate your net income tax due on line 9 by subtracting total other credits in line 8 from the total income tax in line 7.

- Enter the lesser amount of row 6 or row 9 on line 10 to determine your total reforestation tax credit utilized this year.

- Proceed to Part III to compute your carryover amount, noting total reforestation credit available and amount utilized.

- Finally, fill out Part IV to determine your lifetime allowance and balance of reforestation tax credits.

- In Part V, complete the certification of forester section, which must be signed and dated, and include the identifying number.

- Once all fields are accurately completed, you can save changes, download, print, or share the filled form as needed.

Complete your MS DoR 80-315 form online today for a smooth tax credit application process.

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax RateFICA7.65%7.65%State5.00%4.05%Local0.00%0.00%Total Income Taxes24.13%4 more rows • Jan 1, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.