Loading

Get Ms Dor Form 80-155 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-155 online

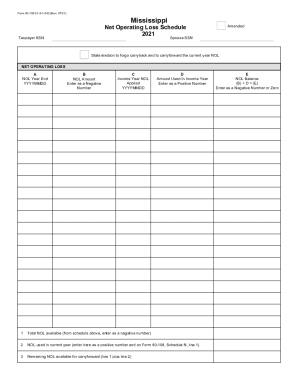

Filling out the MS DoR Form 80-155 is essential for reporting your net operating loss accurately. This guide will help you navigate each section of the form online, ensuring that you submit the required information correctly.

Follow the steps to complete the form online:

- Click ‘Get Form’ button to retrieve the form and open it in the digital editor.

- Enter the taxpayer's social security number (SSN) in the designated field.

- If applicable, input the spouse's social security number in the provided area.

- Indicate your state election to forgo carryback and to carryforward the current year net operating loss (NOL) by checking the appropriate box.

- For the NOL year end, enter the date in the YYYYMMDD format.

- In the NOL amount field, input the NOL amount as a negative number.

- For the income year NOL applied, enter the corresponding date in the YYYYMMDD format.

- Fill in the amount used in the income year, entering this figure as a positive number.

- Calculate the total NOL available by referring to the schedule above, entering it as a negative number.

- Input the NOL used in the current year as a positive number, making sure it matches line 1 on Form 80-108, Schedule N.

- Determine the remaining NOL available for carryforward by adding line 1 and line 2.

- In the NOL balance section, calculate (B) + D and enter the result as a negative number or zero.

- Finally, save your changes, and opt to download, print, or share the form as needed.

Complete your digital documents online with confidence.

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.