Loading

Get Ia Dor 1040_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA DoR 1040_DSA online

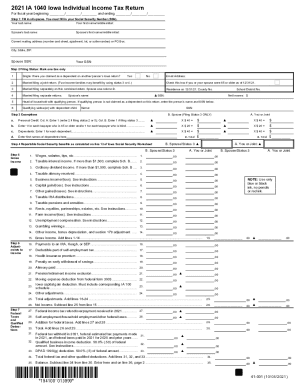

The IA DoR 1040_DSA is the Iowa Individual Income Tax Return form that individuals need to complete to report their income and calculate their tax obligations. This guide provides step-by-step instructions to help users easily fill out this form online, ensuring all necessary information is accurately recorded.

Follow the steps to complete the IA DoR 1040_DSA form online.

- Click 'Get Form' button to obtain the IA DoR 1040_DSA and open it for editing.

- Begin filling in your details. You must enter your Social Security Number (SSN), last name, and first name/middle initial. If applicable, enter your spouse’s last name and first name/middle initial as well. Provide your current mailing address including PO Box, city, state, and ZIP code.

- Mark your filing status by selecting only one option from the provided list. The options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Be sure to check the box if either you or your spouse were 65 or older as of the end of the tax year.

- Proceed to exemptions by filling in the required information for personal credits and dependents. Enter the applicable personal credit amounts based on the number of individuals in your household who are eligible.

- Report your total taxable income. This includes various income sources such as wages, taxable interest, business income, pensions, and more. Follow the instructions carefully to record each type of income on the appropriate lines.

- Complete the adjustments to income section, which may include payments to an IRA or deductions for moving expenses. Ensure calculations are accurate to determine your total net income.

- Calculate your taxable income. Deduct any applicable deductions from your gross income to find your taxable income, and then calculate your total tax based on provided tables or rates.

- Enter any credits you may be eligible for, including the tuition credit for dependents and other refundable credits. Keep in mind to enter all values in whole dollars.

- Complete the refund section indicating any overpayment or tax owed. If you expect a refund, fill out your banking information for direct deposit.

- Finish by signing the form. Each taxpayer must sign and date the return before submission. Additionally, confirm that all required documents, such as W-2 forms, are attached.

- Once the form is filled out completely, you can save your changes, download, or print the completed IA DoR 1040_DSA for submission.

Begin filling out your IA DoR 1040_DSA online today to ensure compliance and accuracy in reporting your income.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.