Loading

Get Ri Dot Ri-w3 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI DoT RI-W3 online

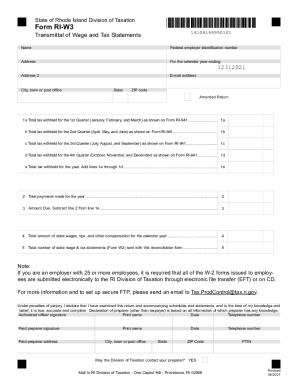

Filling out the RI DoT RI-W3 form is an essential task for employers in Rhode Island to report wage and tax information accurately. This guide provides a clear and professional overview of the steps necessary to complete this online form effectively.

Follow the steps to fill out the RI DoT RI-W3 form online.

- Click ‘Get Form’ button to access the RI DoT RI-W3 document and open it in the editing interface.

- Enter the employer's name and address in the appropriate fields. Ensure that the information matches the official records.

- If you see a pre-printed employer's withholding reconciliation account ID on the form, ensure it is correct. If not, enter your identification number as needed.

- Fill in the calendar year ending date in the designated field.

- Complete the tax withheld sections by entering the total amounts for each quarter as indicated on Form RI-941.

- Calculate the total tax withheld for the year by adding the figures from the quarterly sections and enter this total.

- Detail the total payments made during the year in the specified area.

- Determine the amount due by subtracting the total payments from the total withheld amount.

- Provide the total amount of state wages, tips, and other compensation for the calendar year.

- Indicate the total number of state wage and tax statements (Form W-2) you are submitting with this form.

- Review all entries for accuracy. Ensure that no remittance for taxes withheld is enclosed with this form.

- Finalize your submission by saving changes, downloading, printing, or sharing the completed form.

Complete the RI DoT RI-W3 and ensure compliance by submitting your forms online today.

You should consider other deductions from your paycheck, such as Social Security tax, Medicare tax, state tax, local tax, insurance premiums, retirement contributions, etc., to determine if you're comfortable with your take-home pay amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.