Loading

Get Ri Tx-17 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TX-17 online

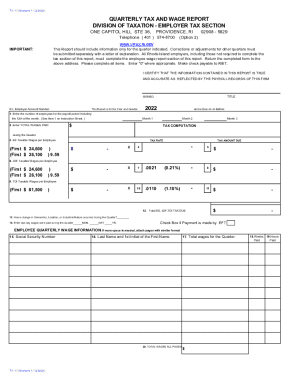

The RI TX-17 form, also known as the quarterly tax and wage report, is essential for Rhode Island employers to report wages and taxes. This guide provides a clear, step-by-step approach to completing the form online effectively.

Follow the steps to successfully fill out the RI TX-17.

- Click ‘Get Form’ button to access the RI TX-17 document and open it in your preferred editing tool.

- Enter your Rhode Island employer account number at the top of the form. This is necessary for identification.

- Indicate the year and quarter for which you are filing the report. Ensure the correct quarter is selected.

- Complete the section asking for the number of employees who were on the payroll, including those employed part-time or full-time during the period.

- Input total wages paid for each month of the quarter. This amount must include all forms of compensation.

- Calculate the Employment Security taxable wages and enter these figures based on the rates specified for the quarter.

- Determine the total taxes due by entering values from previous steps into the designated fields.

- If applicable, indicate any changes in ownership, location, or industrial nature during the quarter.

- Record the last day wages were paid during the quarter, or enter 'None' if no wages were disbursed.

- Complete the Employee Quarterly Wage Information section by listing each employee's social security number and names.

- Enter the total wages paid to each employee, as well as the number of weeks and hours they were compensated for.

- Verify all information for accuracy and completeness, ensuring there are no missed entries.

- Sign the form in the designated space to certify that the information provided is accurate.

- Save your changes and choose to download, print, or share the completed form as required.

Start filling out the RI TX-17 online today to ensure compliance with quarterly tax requirements.

Rhode Island Tax Account Numbers The first 9 digits of your new account number should match your federal EIN. If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.