Loading

Get Ri Tx-16 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI TX-16 online

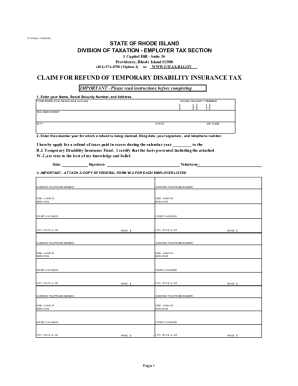

Filling out the RI TX-16 form online can simplify the process of claiming your refund for temporary disability insurance tax. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your RI TX-16 form.

- Press the ‘Get Form’ button to access the online form and open it in your editing platform.

- In section 1, enter your full name, Social Security number, and address. Ensure the information is complete and accurate to avoid processing delays.

- In section 2, specify the calendar year for which you are claiming a refund, your filing date, and sign your name. Include your telephone number for any follow-up inquiries.

- List each Rhode Island registered employer in section 3. Include the employer's name, address, telephone number, and the wages paid to you. Make sure each employer is listed separately.

- Attach a copy of the Federal Form W-2 for each of your listed employers. Ensure that each W-2 is a legitimate copy and readable, as photocopies will not be accepted.

- Review your completed RI TX-16 form to check for any errors or omissions. Sign the form before submitting it to confirm the accuracy of the information provided.

- Submit your completed form to the address specified at the end of the instructions. Ensure it is sent to the Division of Taxation - Employer Tax Section in Providence, RI.

Complete your RI TX-16 form online today and ensure you receive your refund promptly.

Your weekly benefit rate will be equal to 4.62% of the wages paid to you in the highest quarter of your Base Period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.