Loading

Get Business Axes For Hotels And R - Kansas Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Axes For Hotels And R - Kansas Department Of ... online

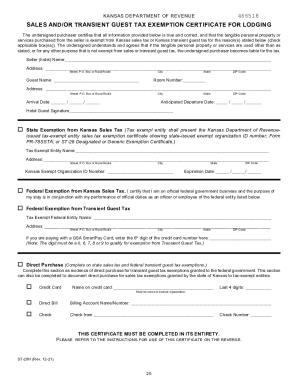

This guide provides step-by-step instructions for completing the Business Axes For Hotels And R form online. By following these clear guidelines, you can ensure accurate submissions while adhering to Kansas tax regulations.

Follow the steps to effectively complete your form.

- Press the ‘Get Form’ button to download the Business Axes form and open it in your preferred editor.

- Begin by filling in your business information, including the name, address, and contact details. Ensure that every field is complete to avoid processing delays.

- Review the tax types applicable for your establishment, such as Retailers' Sales Tax, Transient Guest Tax, and Liquor Drink Tax. Input the details accordingly.

- Calculate the taxes owed based on your gross receipts. Make sure to follow the tax rate relevant to your locality.

- Double-check all figures for accuracy, ensuring deductions are appropriately claimed where applicable.

- Once all fields are complete and accurately filled, look for options to save changes, download, print, or share your completed form.

Take action now and complete your Business Axes form online with confidence!

Kansas has a 4.00 percent to 7.00 percent corporate income tax rate. Kansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 4.25 percent, and an average combined state and local sales tax rate of 8.66 percent. Kansas's tax system ranks 25th overall on our 2022 State Business Tax Climate Index.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.