Loading

Get Ks Dor Cr-16 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR CR-16 online

Filling out the Kansas Department of Revenue's CR-16 form is an essential step for businesses looking to register for various tax types in Kansas. This guide provides clear, step-by-step instructions to help you navigate the online form confidently.

Follow the steps to complete your KS DoR CR-16 online.

- Press the ‘Get Form’ button to acquire the form and open it in your document editor.

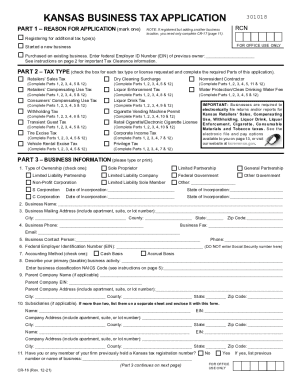

- Review Part 1 - Reason for Application. Select one of the options provided: registering for additional tax type(s), starting a new business, or purchasing an existing business. If you are purchasing an existing business, ensure you enter the federal Employer Identification Number (EIN) of the previous owner.

- Move to Part 2 - Tax Type. Check the boxes for each tax type or license you are requesting. Be aware that each selection may require you to complete specific parts of the application.

- In Part 3 - Business Information, fill out your type of ownership by selecting the appropriate checkbox. Then, provide your business name, mailing address, and contact details. Be sure to list your Federal Employer Identification Number (EIN) correctly and describe your primary business activity.

- Complete Part 4 - Location Information. If you have only one business location, simply fill out this section. Include the trade name, location details, and other relevant information.

- Proceed to Parts 5, 6, and 7, filling in the details for Sales Tax and Compensating Use Tax, Withholding Tax, and Corporate Income Tax respectively. Each part includes specific questions about your business operations that you will need to address.

- In Parts 8 through 11, provide the necessary information related to liquor enforcement, liquor drink tax, and any applicable contractor classifications. Ensure you complete any additional forms referenced in these sections.

- Finally, complete Part 12 - Ownership Disclosure and Signature Statement. List all relevant owners and partners, ensure signatures are provided for all individuals listed, and accurately enter dates and contact information.

- Once all sections have been filled out, review the form for accuracy, save your changes, and make sure to download, print, or share the completed form as needed.

Complete your KS DoR CR-16 form online today and ensure your business is properly registered for tax purposes.

Some customers are exempt from paying sales tax under Kansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.