Loading

Get Business Ax Application - Kansas Department Of Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Tax Application - Kansas Department Of Tax online

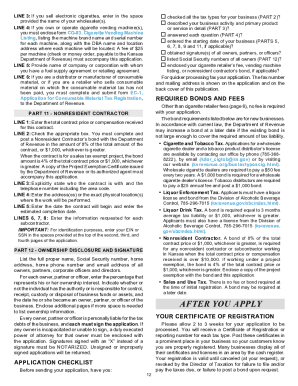

This guide provides clear, step-by-step instructions for successfully completing the Business Tax Application from the Kansas Department of Tax. Designed for new business owners, it covers each section and field of the form to ensure compliance with Kansas tax laws.

Follow the steps to complete your application effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read through the entire form to understand the requirements and information needed.

- Begin filling out Part 1 by indicating the reason for your application; mark only one box from the options provided.

- In Part 2, check all applicable tax types you are applying for and make sure to complete the necessary parts of the application associated with each selected tax type.

- Proceed to Part 3 and provide detailed business information, including the type of ownership, business name, mailing address, and contact information. Ensure accurate completion of the federal Employer Identification Number (EIN) field.

- In Part 4, provide location information, including the business address and description of primary activities, ensuring to list the correct NAICS code.

- Fill out Part 5 regarding sales tax and compensating use tax, indicating the date sales commenced and estimating your tax liability.

- Complete Part 6 for withholding tax details, including the start date of taxable payments and estimated annual tax.

- If applicable, complete Parts 7 through 11 for additional tax types such as corporate income tax or liquor enforcement tax.

- In Part 12, disclose the ownership details and ensure all required signatures are obtained before submission.

- Review the application checklist to confirm all sections are completed accurately, then save the changes to your document.

- Finally, download, print, or share the filled application as necessary, and submit it to the Kansas Department of Revenue.

Start your online application now to successfully register your business with the Kansas Department of Revenue.

Your Access Code can be obtained from the Kansas Department of Revenue by email KDOR_IncomeEServ@ks.gov or 785-368-8222 option 4, if you filed the income tax return in the past three years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.