Loading

Get Ks Dor St-36_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

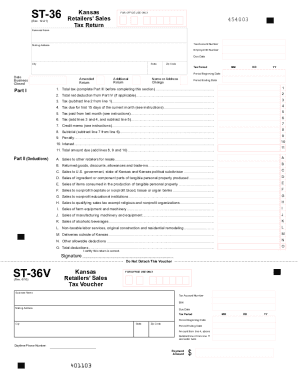

How to fill out the KS DoR ST-36_DSA online

Filling out the KS DoR ST-36_DSA online can streamline your sales tax reporting process. This guide will provide you with comprehensive, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your business name, tax account number, mailing address, and period-related details at the top of the form.

- In Part I, enter the total tax amount from Part III on line 1 and any applicable deductions from Part IV on line 2.

- Complete lines 3 through 11 in Part I, making calculations as directed and ensuring that amounts are calculated accurately—be attentive to whether your filing frequency is accelerated.

- Proceed to Part II to itemize any applicable deductions by filling out lines A through O. Make sure to total these deductions accurately.

- Move to Part III, where you will need to list your sales and deductions by jurisdiction. Complete the columns with the appropriate data for gross sales, merchandise consumed, and deductions.

- If your form requires additional details, utilize the Part III Supplement Schedule to provide more space for your entries.

- For utility providers, complete Part IV based on the specific deductions for residential and agricultural customers, ensuring you calculate totals accurately in the relevant columns.

- Once all information is entered, review the form for accuracy, making sure to check the totals on all applicable lines.

- Finally, save your changes, download the completed form, print a copy for your records, or share it electronically as required.

Complete your KS DoR ST-36_DSA form online today to simplify your tax reporting process.

Kansas taxes can be paid by credit card through the following vendors: ACI Payments, Inc. Payments can also be made by telephone through ACI Payments, Inc. by calling 1-800-2PAYTAX (1-800-272-9829).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.