Loading

Get Ky Form 2210-k 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form 2210-K online

Filling out the KY Form 2210-K online is essential for individuals who need to determine whether they owe an underpayment of estimated tax penalty. This guide provides clear, step-by-step instructions to help you successfully complete the form with ease.

Follow the steps to complete and submit the form online.

- Click ‘Get Form’ button to obtain the form and open it in your designated document editor.

- Begin by entering your name as shown on your Kentucky tax return, Form 740, 740-NP, or 741.

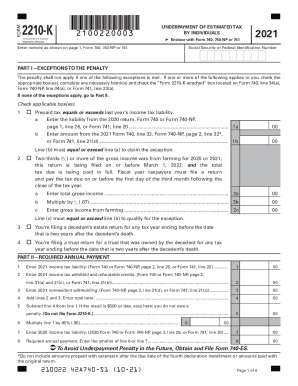

- In Part I, review the exceptions to the penalty. If any apply to you, check the corresponding box or boxes and fill in the necessary lines.

- For exception 1, enter last year's income tax liability and the amount from your current return to confirm the eligibility for the exception.

- For exception 2, assess if two-thirds or more of your gross income was from farming and ensure to complete lines for gross income.

- Proceed to Part II, where you will calculate your required annual payment. Enter your total income tax liability, withheld tax, and refundable credits as instructed.

- Perform the necessary calculations to determine if you owe a penalty, and ensure to follow the guidelines about what to enter on lines 5 and 8.

- If using the annualized income installment method (Part III), complete the sections as applicable to your income situation.

- Once all the information is filled in, save your changes to the document. You can download, print, or share the completed form as needed.

Complete your KY Form 2210-K online today for efficient document management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

We calculate the penalty based on: The amount of the underpayment. The period when the underpayment was due and underpaid. The interest rate for underpayments that we publish quarterly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.