Loading

Get Ky Dor 42a900 (42a811) 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 42A900 (42A811) online

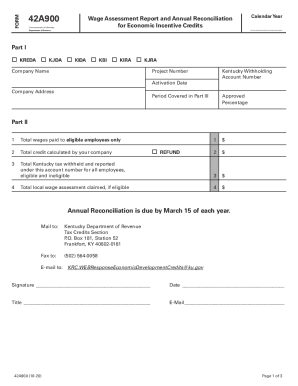

The KY DoR 42A900 (42A811) is a Wage Assessment Report and Annual Reconciliation for Economic Incentive Credits issued by the Commonwealth of Kentucky. This guide offers clear instructions for completing the form online, ensuring that users follow each step accurately to facilitate a smooth filing process.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to access the document and open it in an online editing tool.

- In Part I, select the relevant economic development credit by checking the appropriate box. Enter the company name, project number, activation date, Kentucky withholding account number, and the approved percentage as specified in your agreement with the Cabinet for Economic Development. Also, indicate the period covered as per the date range applicable.

- In Part II, enter the total wages paid to eligible employees in line 1. For line 2, calculate and enter the total credit your company is claiming. In line 3, document the total Kentucky tax withheld for all employees, regardless of eligibility. Finally, for line 4, indicate the total local wage assessment claimed, if applicable.

- Move to Part III where you will need to input detailed information regarding each eligible employee. Fill in the necessary columns, ensuring that you include the last four digits of the Social Security Number, state of residency, hire dates, wages paid for the period, state tax withheld, and credit claimed.

- Review the calculations in columns H, I, and J to confirm the accuracy of the credit claimed. Make sure to follow guidelines for employees from states with reciprocal agreements with Kentucky.

- Complete the form by signing and dating it appropriately. Include your title and email for further communication or queries.

- Once completed, save your changes, and utilize options to download, print, or share the form as necessary. Ensure that you submit the form by the March 15 deadline, either by mail, fax, or email to the Department of Revenue.

Complete your documents online now to ensure compliance and timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

All Kentucky wage earners are taxed at a flat 4.5% tax rate with an allowance for the standard deduction.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.