Loading

Get Admitted Premium Tax Tables, Forms And Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Admitted Premium Tax Tables, Forms And Instructions online

Filling out the Admitted Premium Tax Tables, Forms And Instructions can be an essential task for individuals managing their tax obligations. This guide aims to provide clear, step-by-step instructions to help users complete this form successfully online.

Follow the steps to accurately complete your tax tables and forms

- Click ‘Get Form’ button to obtain the form and open it in your online document editor.

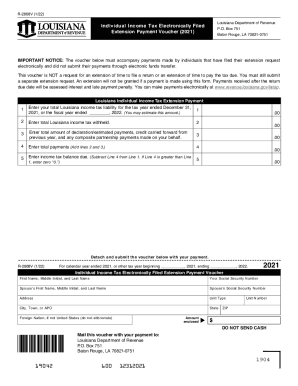

- Begin by entering your total Louisiana income tax liability for the tax year ending December 31, 2021, or for the fiscal year in the specified field. You may provide an estimated amount if necessary.

- In the next field, input the total amount of Louisiana income tax that was withheld from your income during the tax year.

- Next, indicate the total of any declaration or estimated payments made, or any credits carried forward from the previous year. Include any composite partnership payments made on your behalf in this calculation.

- Calculate the total payments by adding the amounts from lines 2 and 3, and enter the sum into the corresponding field.

- Finally, compute the income tax balance due by subtracting the total payments recorded on line 4 from the tax liability shown on line 1. If your total payments exceed your liability, simply enter zero (0) in this field.

- Complete the personal information section, including your name, social security number, and address details. Ensure accuracy in this section.

- Once you have filled out all necessary fields, review your entries for accuracy. After confirming that the information is correct, you can save your changes, download, print, or share the completed form as needed.

Begin filling out your Admitted Premium Tax Tables, Forms And Instructions online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In response to the rejection of an electronically filed return that's missing the Form 8962, individuals may refile a complete return by completing and attaching Form 8962 or a written explanation of the reasons for its absence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.