Loading

Get Mi 5678 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5678 online

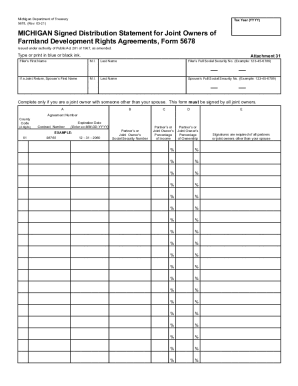

Filling out the MI 5678 form is essential for joint owners of farmland development rights agreements in Michigan. This guide will provide you with clear and detailed steps to complete the form accurately and effectively online.

Follow the steps to successfully complete the MI 5678 form online.

- Click the 'Get Form' button to access the MI 5678 document and open it for editing.

- Enter the tax year in the YYYY format at the top of the form.

- Fill in the filer’s first name, middle initial, and last name in the respective fields.

- Provide the filer’s full Social Security number using the format 123-45-6789.

- If filing a joint return, enter the spouse’s first name, middle initial, and last name.

- Input the spouse’s full Social Security number in the same format.

- If you are a joint owner with someone other than your spouse, complete the section for partner's or joint owner's information, including their first name, middle initial, and last name.

- Fill in the partner's or joint owner's Social Security number in the format specified.

- Indicate the partner's or joint owner's percentage of income and percentage of ownership in the appropriate fields.

- Collect necessary signatures from all partners or joint owners other than your spouse.

- Provide the agreement number and contract number as required on the form.

- Enter the expiration date in the MM-DD-YYYY format.

- Once all fields are completed, review the form for accuracy. You can then save changes, download, print, or share the completed form as needed.

Begin filling out the MI 5678 online today for a seamless submission process.

Related links form

Bonuses and other payments of employee compensation made separately from regular payroll payments are subject to Michigan income tax withholding. The withholding amount equals the payment amount multiplied by 4.25 percent (0.0425).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.