Loading

Get Mi 4892 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 4892 online

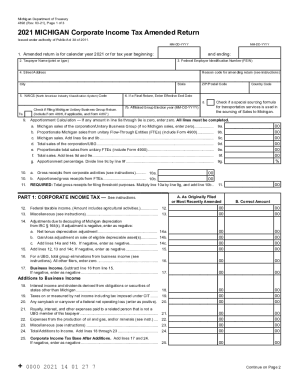

Filing an amended corporate income tax return, known as MI 4892, is crucial for accurate tax reporting. This guide provides step-by-step instructions on completing the form online, ensuring clarity for users regardless of their legal experience.

Follow the steps to complete the MI 4892 online effectively.

- Press the ‘Get Form’ button to access the MI 4892 and open it in your browser for editing. You will have the form on your screen to start filling it out.

- Indicate the tax year for which you are amending the return in the designated section, ensuring to input the correct beginning and ending dates.

- Enter the taxpayer's name, which should be printed or typed clearly in the given field.

- Provide your Federal Employer Identification Number (FEIN) to clearly identify your tax account.

- Fill in the street address, city, state, and ZIP/postal code accurately to avoid any issues with mail correspondence.

- Select the appropriate reason code for amending the return by referencing the codes provided in the instructions; include any necessary explanations on a separate sheet if required.

- Enter your NAICS code, which helps categorize your business activities.

- If this is a final return, indicate the effective end date; otherwise, leave this blank.

- Check the box if filing as part of a Michigan unitary business group, adding any necessary forms as applicable.

- Proceed to the apportionment calculation section, filling out each line related to Michigan sales and revenue. Make sure to include all applicable amounts.

- Continue to fill out your corporate income tax calculations, ensuring to follow the line-by-line breakdown provided in the instructions.

- Review each section for accuracy. Once completed, you can save your changes, download the form, print it, or share it as necessary.

Encourage others to file their documents online for a smoother experience.

If the prior year's tax, including surcharge, is $20,000 or less, estimated tax may be based on 100% of the prior year's total tax liability. This is known as a safe harbor provision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.