Loading

Get Mi 5081 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5081 online

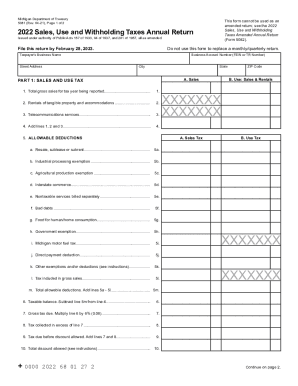

Filling out the MI 5081 form online can be a straightforward process when guided correctly. This guide will provide detailed, step-by-step instructions to help you complete your Michigan Sales, Use and Withholding Taxes Annual Return efficiently and accurately.

Follow the steps to complete and file the MI 5081 form online.

- Click the ‘Get Form’ button to access the MI 5081 form. This will open the form in your online editor, allowing you to begin filling it out.

- Enter the taxpayer’s business name and street address. Include the Business Account Number (FEIN or TR Number), city, state, and ZIP code as required. Ensure that the information provided is accurate and up-to-date.

- In Part 1, Sales and Use Tax, complete lines 1 to 4 by reporting total gross sales, rentals of tangible property, and telecommunications services. Add these figures together and enter the total on line 4.

- Proceed to line 5 for allowable deductions. Carefully review each exemption category (5a-5l) and enter any applicable deductions you are eligible for, substantiating them with appropriate documentation.

- Calculate your taxable balance by subtracting total allowable deductions on line 5m from gross sales reported on line 4. Enter the result on line 6.

- On line 7, compute the gross tax due by multiplying the taxable balance by 6% (0.06). Complete the subsequent lines, including any additional taxes collected and discounts if applicable.

- Continue to Part 2 and Part 3, reporting any use tax owed on unreported purchases and withholding tax information as per lines 13-19 respectively.

- In Part 4, calculate the summary of total taxes due and paid, ensuring all figures are accurate and all necessary amounts are reflected correctly.

- Finally, sign and date the form in Part 5. Ensure that the preparer's certification is completed if applicable, including their identification number and business address.

- Review your completed MI 5081 form for accuracy. Upon confirming all information is correct, you can save, download, print, or share the form as needed.

Take action today and complete your MI 5081 form online for a streamlined filing experience.

Withholding Taxes Annual Return (Form 5081) Form 5081 is available for submission electronically using Michigan Treasury Online (MTO) at mto.treasury.michigan.gov or by using approved tax preparation software.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.