Get Irs 990 - Schedule A 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule A online

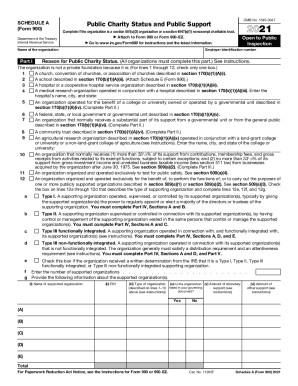

Filling out the IRS 990 - Schedule A is essential for organizations that qualify as tax-exempt under section 501(c)(3) or as nonexempt charitable trusts. This guide provides a clear, step-by-step approach to complete the form online, ensuring you accurately report your organization’s public charity status and public support.

Follow the steps to fill out the IRS 990 - Schedule A with ease.

- Click ‘Get Form’ button to access the IRS 990 - Schedule A and open it in the online editor.

- Begin by entering the name of your organization and its Employer Identification Number (EIN) at the top of the form.

- In Part I, select the correct reason for your public charity status by checking the appropriate box (lines 1 through 12). Ensure you only check one box that best describes your organization.

- If applicable, complete Part II for organizations described in sections 170(b)(1)(A)(iv) or 170(b)(1)(A)(vi). Here, you’ll detail your public support schedule, including the amounts received from various sources.

- Proceed to Part III if your organization doesn’t qualify under Parts I or II. Here, provide additional information as required for organizations described in section 509(a)(2).

- In Part IV, if you identified as a supporting organization, answer all relevant questions about the organization’s supported organizations and governance structure.

- Finally, review your completed sections for accuracy, save your changes, and choose to download, print, or share your filled-out Schedule A, ensuring all required information is retained.

Start completing your IRS 990 - Schedule A online today and ensure your organization maintains its tax-exempt status.

A disqualified person is any person who was in a position to exercise substantial influence over the affairs of the applicable tax-exempt organization at any time during the lookback period. It is not necessary that the person actually exercise substantial influence, only that the person be in a position to do so.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.