Loading

Get Nj Form Nj-2210 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form NJ-2210 online

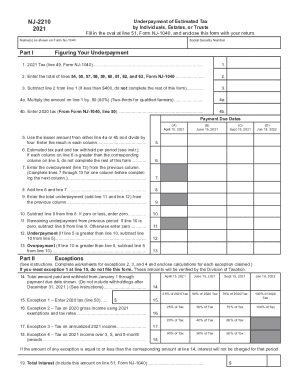

The NJ Form NJ-2210 is essential for individuals, estates, or trusts who may have underpaid their estimated tax. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth filing process.

Follow the steps to successfully fill out the NJ Form NJ-2210 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name(s) as shown on Form NJ-1040, followed by your Social Security Number.

- Complete Part I by calculating your underpayment. Start with your 2021 tax amount from line 49 of Form NJ-1040 in section 1.

- Aggregate the totals of certain specified lines from Form NJ-1040 as indicated in section 2.

- Subtract the total from line 2 from the amount in line 1. If the result is less than $400, you will not need to complete the rest of the form.

- Multiply the amount on line 1 by 0.80 (or two-thirds for qualified farmers) in line 4a. Additionally, enter your 2020 tax from line 50 of Form NJ-1040 in line 4b.

- Determine the lesser amount from lines 4a or 4b, divide by four, and enter this in line 5 for each period's columns.

- Input your estimated tax paid and taxes withheld during the periods as specified in line 6.

- If your entries in line 6 exceed the corresponding amounts in line 5, continue filling the form; otherwise, you do not need to complete it further.

- For each column, complete lines 7 through 13 sequentially to determine any overpayments or underpayments as applicable.

- After completing all necessary calculations, review your entries for accuracy and make any necessary corrections.

- Once you finish filling out the form, you can save your changes, download, print, or share the form as needed.

Start filling out the NJ Form NJ-2210 online today to ensure your tax obligations are met accurately.

Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. You may need this form if: You're self-employed or have other income that isn't subject to withholding, such as investment income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.