Loading

Get Nj Nj-2450 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-2450 online

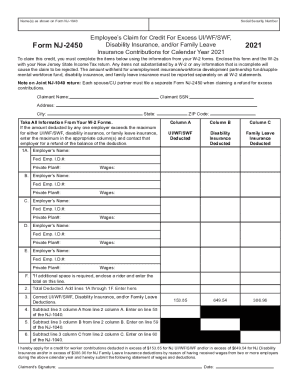

Filing the NJ NJ-2450 form online can seem daunting, but this guide aims to simplify the process. This form is essential for claiming credits for excess contributions made for unemployment insurance, disability insurance, and family leave insurance.

Follow the steps to complete your NJ NJ-2450 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Input the name(s) as shown on your Form NJ-1040 in the 'Claimant Name' field.

- Enter your Social Security Number in the designated area.

- Provide your address, including city, state, and ZIP code.

- Collect your W-2 forms, and transfer the necessary deductions into the corresponding columns for UI/WF/SWF, disability insurance, and family leave insurance.

- For each employer listed in sections 1A to 1F, add the employer's name, Federal Employer Identification Number, Private Plan Number, and wages earned.

- Calculate the total deducted by summing lines 1A through 1F and enter the total in the specified field.

- Before submitting, complete the calculations on lines 3 through 6 to determine correct deductions.

- Sign and date the form to confirm your application for a credit for contributions deducted in excess of the allowed limits.

- Once all fields are accurately filled out, save your changes, and download, print, or share the completed form as necessary.

Complete your NJ NJ-2450 form online today to ensure a seamless filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

New Jersey has a graduated individual income tax, with rates ranging from 1.40 percent to 10.75 percent. There is also a jurisdiction that collects local income taxes. New Jersey has a 6.5 percent to 11.5 percent corporate income tax rate.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.