Loading

Get Irs Instructions 1040 Schedule A 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1040 Schedule A online

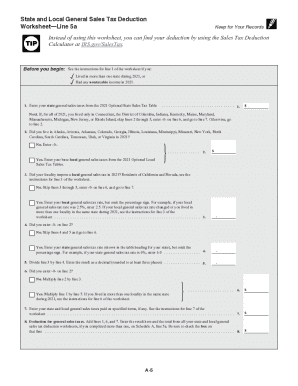

This guide provides clear and comprehensive instructions for completing IRS Instructions 1040 Schedule A. It offers step-by-step guidance to help you easily navigate each section of the form and understand the necessary components to report your itemized deductions efficiently.

Follow the steps to complete IRS Instructions 1040 Schedule A online.

- Press the ‘Get Form’ button to access the IRS Instructions 1040 Schedule A form and open it in your preferred editor.

- Review the introduction section of the form and familiarize yourself with the purpose of Schedule A, which is to calculate your itemized deductions.

- Complete Section 1 on medical and dental expenses. Enter the total qualified medical expenses you paid that exceed 7.5% of your adjusted gross income (AGI).

- Move to Section 2 for taxes you paid. Deduct certain state and local taxes, and enter the total amount on the relevant lines.

- Fill out Section 3 for interest expenses, such as home mortgage interest. Ensure you understand any limits on the deductible amounts.

- Continue to Section 4 for charitable contributions, where you will list all qualifying donations made to eligible organizations.

- In Section 5, provide any casualty and theft losses that apply to federally declared disasters, ensuring to attach the necessary forms if applicable.

- Review the total itemized deductions in the last section. Calculate the total from all previous sections and transfer the final amount to your Form 1040.

- Once all sections are complete, save your changes, download the completed form, print it, or share it as needed.

Complete your IRS Instructions 1040 Schedule A online today to maximize your deductions!

If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses. You can also deduct certain casualty and theft losses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.