Loading

Get Nj Dot Nj-630 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT NJ-630 online

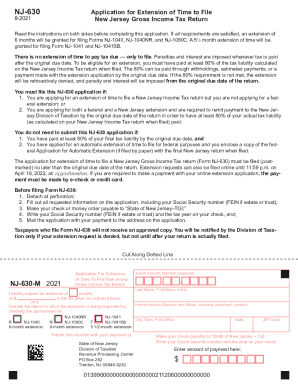

Filling out the NJ DoT NJ-630 form for an extension of time to file your New Jersey Gross Income Tax return can be straightforward with the right guidance. This guide will provide you with step-by-step instructions to complete the form online with confidence.

Follow the steps to successfully complete the NJ DoT NJ-630 form online.

- Click ‘Get Form’ button to access the NJ DoT NJ-630 application and open it in the online editor.

- Detach the form at the perforation as instructed. This ensures you are working with the correct section of the application.

- Fill out all requested information, including your Social Security number or FEIN if you are representing an estate or trust. Ensure accuracy to avoid processing delays.

- Indicate the return for which the extension is being requested by checking the appropriate box. Options include NJ-1040, NJ-1040NR, NJ-1080C, NJ-1041, and NJ-1041SB.

- Complete the extension request by specifying the number of months needed for the extension and the new due date for filing your return.

- Prepare your payment. Make your check or money order payable to 'State of New Jersey – TGI.' Write your Social Security number and tax year on the check before submitting.

- Submit your application with payment to the address provided on the form. Ensure it is postmarked no later than the original due date of the return.

- If filing online, ensure that any required payment is made via e-check or credit card as instructed in the system.

- After completing the process, save changes, download, print, or share the form as needed to maintain a record of your application.

Complete your NJ DoT NJ-630 application online today and ensure timely filing of your tax return.

A New Jersey Estate Tax Return must be filed if the decedent's gross estate, as determined in ance with the provisions of the Internal Revenue Code, exceeds $2 million. The return must be filed within nine (9) months from the decedent's date of death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.