Loading

Get Irs 1065 - Schedule M-3 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule M-3 online

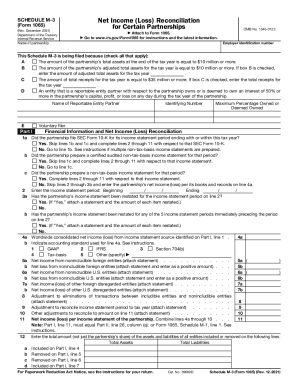

Filling out the IRS 1065 - Schedule M-3 can seem complex, but with organized guidance, you can complete it accurately and efficiently. This guide provides step-by-step instructions tailored to support users with varying levels of experience.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to retrieve the IRS 1065 - Schedule M-3 and open it in your preferred online editor.

- Begin by entering the name of the partnership at the top of the form. Ensure that the employer identification number (EIN) is filled out accurately as this is essential for identification.

- Select the reasons for filing Schedule M-3 by checking the applicable boxes A through E regarding the partnership’s total assets, adjusted total assets, total receipts, or reportable entity partners.

- In Part I, indicate whether the partnership has filed SEC Form 10-K. If yes, proceed to lines 2 through 11 accordingly. If no, complete line 1b. Follow the instructions to determine the correct income statement the partnership prepared.

- For each item listed in Part I (lines 4a to 11), provide the necessary financial information and reconcile net income as instructed. Ensure to attach any required statements for items like foreign entities, adjustments, or restated income.

- In Part II, report income (loss) items starting from line 1 through line 22, making sure to distinguish between temporary and permanent differences. Each entry must be supported by a statement if required.

- Continue into Part III, where you reconcile expense and deduction items, filling lines 1 through 30. Again, categorize the differences as necessary and attach relevant statements.

- After completing all the sections, carefully review the information for accuracy before saving your changes, downloading, printing, or sharing the completed form as needed.

Ensure compliance and streamline your filing by completing the IRS 1065 - Schedule M-3 online today.

What is a Reportable Entity Partner (REP)? A Reportable Entity Partner (REP) is a corporation or p y ( ) p partnership itself required to file Schedule M‐3 that owns, directly or indirectly, 50% or more of a partnership's profit loss or capital profit, loss, or capital.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.