Loading

Get Irs Instruction 1041 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1041 online

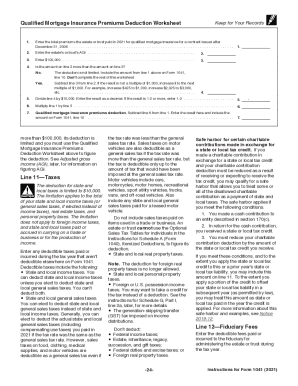

The IRS Instruction 1041 is essential for fiduciaries managing estates and trusts. This guide provides clear instructions on how to accurately complete this form online, ensuring compliance with tax laws.

Follow the steps to fill out the IRS Instruction 1041 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the estate or trust at the top of the form. Ensure it matches the name used for the Employer Identification Number (EIN).

- Provide the name and title of the fiduciary responsible for the form.

- Complete the address section, including suite or room numbers where applicable.

- Indicate the type of entity by checking the appropriate box or boxes that describe the estate or trust.

- Fill in the Employer Identification Number (EIN) for the estate or trust.

- Enter the creation date of the entity, or in the case of a decedent's estate, the date of death.

- Accurately report the income, losses, deductions, and any distributions required for beneficiaries.

- Complete additional schedules as required, such as Schedule K-1, detailing each beneficiary’s share of income or loss.

- After filling out the entire form, review all information for accuracy.

- Save the completed form and utilize options to download or print it for your records or submission.

Prepare your IRS Instruction 1041 online today to ensure timely and accurate filing.

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.