Loading

Get Nj Nj-1040 Schedule Nj-dop 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040 Schedule NJ-DOP online

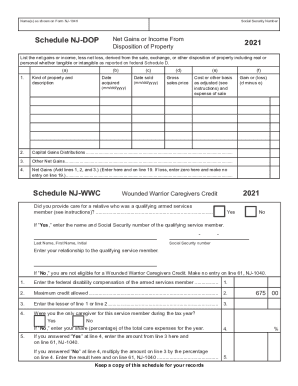

The NJ NJ-1040 Schedule NJ-DOP is essential for reporting gains or income from the disposition of property. This guide will provide you with clear, step-by-step instructions to fill out the form online effectively.

Follow the steps to accurately complete the NJ NJ-1040 Schedule NJ-DOP.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as shown on Form NJ-1040 and your Social Security number at the top of the NJ-DOP Schedule.

- In the section for net gains, list the net gains or income derived from the sale, exchange, or other disposition of property. Include the type of property and a brief description in the corresponding fields.

- Fill in the date the property was acquired and the date it was sold (using the mm/dd/yyyy format).

- Specify the gross sales price of the property in the designated area.

- Complete the cost or other basis as adjusted, along with any sale expenses associated with the property. This information can typically be found on your federal Schedule D.

- If applicable, include capital gains distributions and other net gains in their respective sections on the form.

- Add together lines 1, 2, and 3 to find your total net gains. If this results in a loss, enter zero; otherwise, write the total in the specified line.

- Should you qualify for the Wounded Warrior Caregivers Credit, answer the relevant questions related to caregiving for a qualified armed services member.

- Make sure to provide the required details including the name and Social Security number of the qualifying service member, alongside your relationship to them.

- Follow the flow of questions to determine the maximum credit allowed and enter the lesser amount as instructed.

- Accurately compute and enter your share of the care expenses if you were not the sole caregiver.

- Finally, review your entries for accuracy and completeness. Save your changes, download, print, or share your completed schedule as necessary.

Complete your tax documents online today and ensure your Schedule NJ-DOP is filled out correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Net Gains or Income From Disposition of Property. Report your capital gains and income from the sale or exchange of property. You can deduct the expenses of the sale and your basis in the property from the sales price.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.