Loading

Get Wi I-017i 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI I-017i online

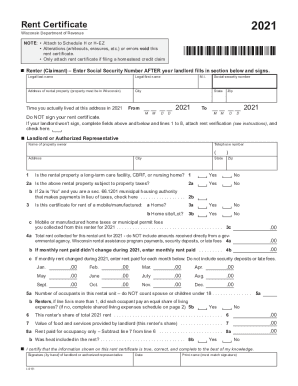

The WI I-017i, also known as the 2021 Rent Certificate, is an essential document for individuals claiming homestead credit in Wisconsin. This guide provides step-by-step instructions to assist users in accurately filling out the form online.

Follow the steps to effectively complete the WI I-017i online.

- Press the ‘Get Form’ button to access the WI I-017i, allowing you to open it in your document editor.

- Complete the 'Renter (Claimant)' section, entering your legal last name, legal first name, and the address of the rental property which must be in Wisconsin. Record the time period you lived at the address and ensure to fill in the date fields correctly.

- In the 'Landlord or Authorized Representative' section, if your landlord is available, they will fill out their information including their name and contact details. If they are unable to sign, check the designated area.

- Answer the questions in sections 1 to 3 regarding the rental property and confirm the property tax status. Ensure to provide accurate responses, particularly for questions relating to your occupancy or any shared living situations.

- Input the total rent collected for the unit for 2021 in section 4. If the rent varied throughout the year, document the rent for each month in the designated fields.

- If applicable, complete the 'Shared Living Expenses Schedule' on page 2 if you indicate that multiple occupants share expenses differently. List the names of other occupants and calculate each person’s share of living expenses accurately.

- Once all the sections are completed, review the entire form for accuracy. Save all changes made.

- Download and print the form, and ensure your landlord has signed it before submission. Use the completed form to accurately fill in any necessary amounts on Schedule H or Schedule H-EZ.

Start completing your WI I-017i form online now to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The maximum credit allowed is $1,168. Household income includes all taxable and certain nontaxable income, less a deduction of $500 for each qualifying dependent. If household income is $24,680 or more, no credit is available. Property taxes are those levied for 2022, regardless of when they are paid.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.