Loading

Get Wi I-016a 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI I-016a online

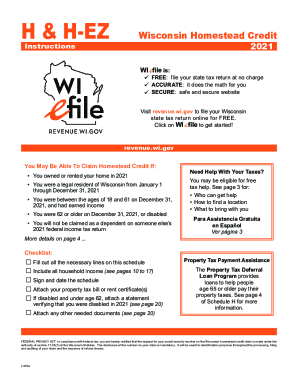

Filling out the WI I-016a form online can streamline your application for the Wisconsin Homestead Credit. This guide provides clear, step-by-step instructions to help you navigate each section of the form efficiently.

Follow the steps to fill out the WI I-016a correctly.

- Press the ‘Get Form’ button to access the online WI I-016a form.

- Begin by entering your personal information, including your legal name and current address. Be sure to use uppercase letters for clarity.

- Indicate your qualifying status by responding to the questions related to your age, residency, and income.

- Provide household income details, ensuring you accurately report all sources of income as defined in the guidelines.

- If applicable, report property taxes, ensuring you round figures to the nearest whole dollar and avoid using commas or dollar signs.

- Attach any necessary documents, such as your property tax bill or rent certificate. Ensure these are clear and legible.

- Review your completed form for accuracy and completeness before submitting it.

- Once everything is filled out and verified, you can save changes, download, print, or share your completed form.

Start filling out your documents online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A rent certificate or property tax bill is used to verify the amount of rent paid or property tax accrued you are claiming for purposes of homestead credit. If a copy of the property tax bill is not available, you may use a printout from the county or municipal treasurer or their website.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.