Loading

Get Irs 8453-s 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-S online

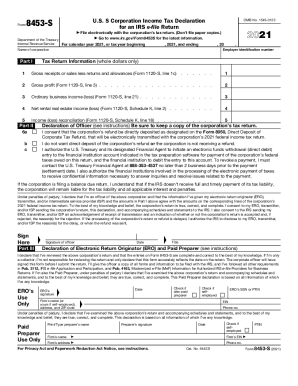

Filing the IRS 8453-S form online is an essential step in completing your corporation’s e-file return. This guide provides clear, step-by-step instructions to help you accurately fill out the form, ensuring compliance and efficiency.

Follow the steps to complete the IRS 8453-S form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the corporation in the designated field at the top of the form.

- Provide the employer identification number (EIN) in the appropriate box.

- Fill in the gross receipts or sales, gross profit, ordinary business income (loss), net rental real estate income (loss), and income (loss) reconciliation, as per the related lines from your Form 1120-S.

- In Part II, complete the declaration of the officer by checking the appropriate boxes regarding the corporation’s refund preferences and payment authorizations.

- Sign and date the form in the designated section for the corporate officer.

- If applicable, complete Part III for the declaration of the electronic return originator (ERO) and paid preparer, ensuring appropriate signatures and information are provided.

- Once all sections are complete and verified, save changes to the form. You can then download, print, or share the completed form as necessary.

Start filling out your IRS 8453-S form online today for a smooth filing experience.

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.