Loading

Get Pr 480.20(cpt) 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.20(CPT) online

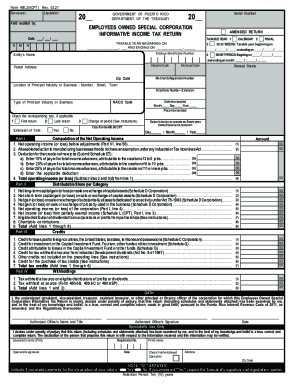

This guide provides clear instructions for completing the PR 480.20(CPT) form, which serves as the informative income tax return for Employees Owned Special Corporations in Puerto Rico. By following these steps, users with varying degrees of familiarity with tax forms can successfully fill out the form online.

Follow the steps to complete the PR 480.20(CPT) form online.

- Click the ‘Get Form’ button to access the form online and open it in your browser.

- Enter the tax year for which you are filing in the section labeled ‘Taxable Year Beginning On’ and ‘Ending On’. Make sure to use the correct date format: day, month, year.

- Fill in the employer identification number and entity's name accurately. This ensures that your corporation is correctly identified in the tax records.

- Indicate whether this return is an amended return, and if applicable, check the appropriate box for ‘First return’, ‘Last return’, or ‘Extension of Time’.

- Complete Part I for the computation of net operating income by entering the specified figures for income before adjustments, allowable deductions, and any job creation deductions as necessary.

- In Part II, provide details for distributable shares per category, ensuring that you accurately report any gains or losses from asset transactions.

- Complete Part III through Part XII by providing the necessary financial and operational details as indicated in each section, specifically focusing on deductions, credits, withholdings, and the comparative balance sheet.

- Review the oath section, and ensure that the authorized officer provides their name, title, signature, and the date to affirm the accuracy of the form.

- Once all necessary fields are filled, save changes and export the form. Options to download, print, or share are available for your convenience.

Begin filling out the PR 480.20(CPT) form online today to ensure compliance with Puerto Rico's tax requirements.

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.