Loading

Get Il Dor Il–1040 Schedule Nr 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR IL–1040 Schedule NR online

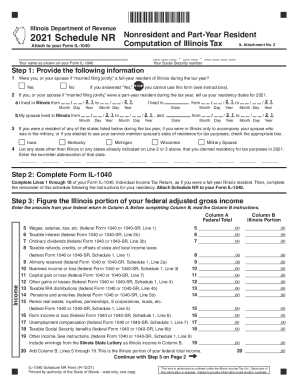

The IL DoR IL–1040 Schedule NR is essential for nonresidents and part-year residents to report their income and calculate their Illinois tax liabilities accurately. This guide provides comprehensive step-by-step instructions to help users complete the form online with ease.

Follow the steps to fill out the IL DoR IL–1040 Schedule NR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as shown on your Form IL-1040 and your Social Security number. Ensure this information is accurate to avoid any processing delays.

- Answer the residency questions. If you were a full-year resident, check ‘Yes’ and note you cannot use this form. If part-year, provide the dates of your residency in Illinois.

- If applicable, indicate if you were a resident of states like Iowa, Kentucky, Michigan, or Wisconsin, or if you are a military spouse by checking the appropriate box.

- List any other states where you claimed residency for tax purposes in 2021 by entering their two-letter abbreviations.

- Complete Lines 1 through 10 of your Form IL-1040 as if you were a full-year resident, following the specific guidance provided for your residency.

- Enter the Illinois portion of your federal adjusted gross income by transferring data from your federal return into Column A and filling out Column B according to the instructions given.

- Figure your Illinois additions and subtractions, ensuring to read the instructions for Columns A and B carefully.

- Calculate your Illinois income and tax by following the steps from Line 46 to Line 52, ensuring accuracy in your calculations.

- Once completed, save changes, download, print, or share the form as necessary.

Complete your IL DoR IL–1040 Schedule NR online today for a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Schedule NR, Nonresident Computation of Fiduciary Income allows a trust or estate that is a nonresident of Illinois to determine the income that is taxable to Illinois. This schedule isn't used by Illinois resident trusts and estates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.