Loading

Get Mo Form E-1r 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-1R online

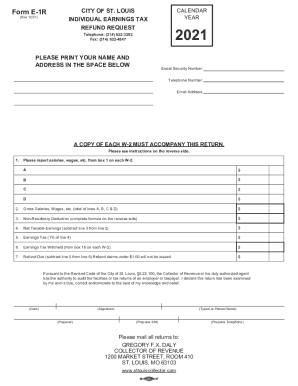

Filling out the MO Form E-1R online can be straightforward if you follow the appropriate steps. This guide is designed to help you navigate the process effectively, ensuring that you complete your refund request accurately.

Follow the steps to accurately fill out the MO Form E-1R online.

- Press the ‘Get Form’ button to access the MO Form E-1R and open it in your preferred online editor.

- Fill in your personal information in the designated fields. Include your full name, mailing address, Social Security number, telephone number, and email address.

- Enter the total gross wages from box 1 of each W-2 into lines A, B, C, and D. Ensure that you exclude any income derived from stock options.

- Calculate the total of lines A, B, C, and D and input this amount into box 2 to represent your gross salaries.

- Complete the non-residency deduction formula on the reverse side of the form and enter the result in box 3.

- Subtract the amount in box 3 from the amount in box 2 to determine your net taxable earnings. Input this amount in box 4.

- Calculate 1% of the amount in box 4 and enter it in box 5, as this represents your earnings tax.

- Input the total amount of earnings tax withheld from each W-2 in box 6.

- Calculate the refund due by subtracting the amount in box 5 from the amount in box 6 and enter this figure in box 7.

- Review your completed form for accuracy. Once confirmed, you can save changes, download, print, or share the form as needed.

Start your refund request by filling out the MO Form E-1R online today!

Who Does Not Pay Earnings Tax? Retirees whose income is from Social Security, pensions, retirement accounts and other non-earned income sources do not pay the e-tax. Others who are exempt include active military in combat zones and non-profits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.