Loading

Get Mo E-234 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO E-234 online

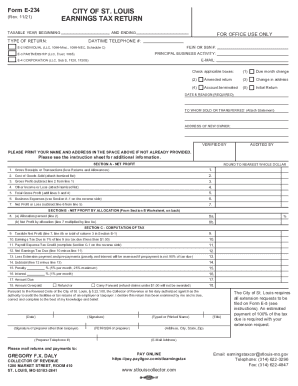

Filling out the MO E-234 form is an essential process for reporting earnings tax in the City of St. Louis. This guide will provide clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to complete the MO E-234 form online.

- Use the 'Get Form' button to access the MO E-234 form and open it in your chosen editor.

- Begin by entering the taxable year, indicating both the start and end dates. This information is crucial for accurate reporting.

- Select the appropriate type of return by checking the applicable box. Options include E-2 for individual returns, E-3 for partnerships, and E-4 for corporations.

- Fill in your daytime telephone number, FEIN or SSN, and provide your email address for communication purposes.

- Check all applicable boxes indicating due month changes, amended returns, or other relevant changes. Include the date and reason as required.

- In Section A, provide detailed information about your net profit. List gross receipts, cost of goods sold, gross profit, and any other income or losses, rounding to the nearest whole dollar.

- Complete Section B, which focuses on the allocation of net profit by entering the allocation percent and calculating net profit by allocation.

- In Section C, compute the taxable net profit and the earnings tax due, ensuring to subtract any payroll expense tax credits you qualify for.

- Finally, review the entire form for accuracy before making any declarations about the completeness and truthfulness of the information provided.

- Once completed, save your changes and choose the appropriate options to download, print, or share the form as needed.

Complete your document online today to ensure timely and accurate filing.

You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.