Loading

Get Pr 482.0(c) 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 482.0(C) online

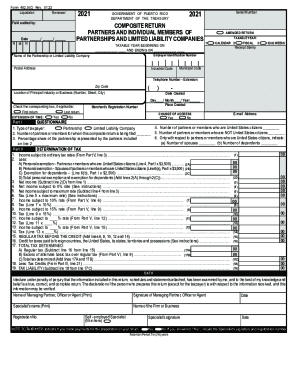

The PR 482.0(C) form serves as a composite return for partnerships and individual members of partnerships and limited liability companies in Puerto Rico. This guide provides a detailed, step-by-step approach to filling out this important document online.

Follow the steps to complete the PR 482.0(C) online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor of choice.

- Begin by entering the date of the return in the designated fields, along with the tax year applicable to this form.

- Provide the employer identification number and the name of the partnership or limited liability company, followed by the postal address and industrial code.

- Complete the municipal code and telephone number with extension, followed by your zip code and the location of the principal industry or business.

- Indicate whether this is the first return, last return, or if you are requesting an extension of time.

- Fill in the e-mail address and check if there is a change of address for the entity.

- In Part I, answer the questionnaire regarding the type of taxpayer and the number of partners or members.

- Proceed to Part II, where you will determine tax. Fill in applicable income subjects and exemptions details accurately.

- Continue to Parts III and IV to declare any tax credits and tax due or paid in excess.

- When all sections are filled, review your entries for accuracy to ensure compliance.

- Finally, save your changes, download the completed form, and choose to print or share it as needed.

Complete your PR 482.0(C) form online to ensure timely and accurate submission.

Act 60 offers a corporate tax rate of 4% to Puerto Rican companies that export services performed in the territory to people or companies outside of the territory. This is ideal for online entrepreneurs and service providers who have U.S. businesses, employees and clients.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.