Loading

Get La Dor R-10605 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-10605 online

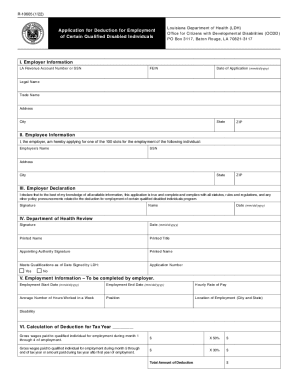

This guide provides clear instructions for filling out the LA DoR R-10605, an application for deduction for the employment of certain qualified disabled individuals. By following the steps outlined below, users can ensure accurate completion of the form for submission to the Louisiana Department of Health.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the LA DoR R-10605 and open it in your preferred online editing tool.

- In Section I, input employer information including your LA Revenue Account Number or SSN, FEIN, date of application, legal name, trade name, and address. Make sure all entries are accurate.

- Proceed to Section II to provide employee information. Include the employee's name, SSN, address, and city. This section verifies that the deduction is applied for the designated individual.

- In Section III, you will make a declaration. Confirm that the provided information is true and compliant with relevant laws. Sign, print your name, and date the application for authenticity.

- Once you submit the form, it will be reviewed by the Department of Health, which will fill out Section IV. This section requires their signature, printed name, and title, as well as confirmation of the employee meeting qualifications.

- In Section V, provide details regarding employment. Include employment start date, end date, hourly rate of pay, average number of hours worked weekly, position, location of employment, and the disability related to the employee.

- Finally, Section VI requires you to calculate the total deduction for the tax year. Enter the gross wages for the first four months, apply the 50% calculation, then enter the gross wages for months five through the end of the tax year at a 30% rate. Sum these amounts for the total deduction.

- Save changes to the form. You can then download, print, or share the completed document as needed. Remember to attach this form to your tax return to claim the deduction.

Complete your documents online today to ensure a smooth submission process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.