Loading

Get Irs Ira Required Minimum Distribution Worksheet

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS IRA Required Minimum Distribution Worksheet online

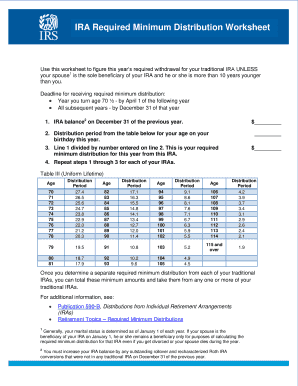

This guide offers a clear and supportive approach to filling out the IRS IRA Required Minimum Distribution Worksheet online. Understanding this process is essential for ensuring compliance with required minimum distribution rules.

Follow the steps to accurately complete the worksheet.

- Click ‘Get Form’ button to access the worksheet and open it in your chosen online tool.

- Locate line 1, where you will input your IRA balance as of December 31 of the previous year. This figure is crucial for calculating your distribution.

- Divide the amount you entered on line 1 by the number you recorded on line 2. This will yield your required minimum distribution for this year, which should be placed on line 3.

- If you have multiple traditional IRAs, repeat steps 1 through 4 for each IRA to determine individual distributions.

- Once all minimum distributions are calculated, you can combine these amounts and withdraw them from any one or more of your traditional IRAs as needed.

- After completing the worksheet, you can save any changes, download, print, or share the form according to your requirements.

Start completing your IRS IRA Required Minimum Distribution Worksheet online today.

IRAs: The RMD rules require traditional IRA, and SEP, SARSEP, and SIMPLE IRA account holders to begin taking distributions at age 72, even if they're still working. Account holders reaching age 72 in 2022 must take their first RMD by April 1, 2023, and the second RMD by December 31, 2023, and each year thereafter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.