Loading

Get Irs 6198 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 6198 online

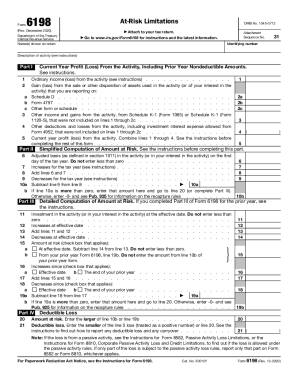

This guide provides a comprehensive overview of how to complete the IRS Form 6198, used to report at-risk limitations for certain activities. By following the detailed steps outlined below, users can efficiently fill out this form online.

Follow the steps to accurately complete the IRS 6198 online

- Click the ‘Get Form’ button to access the form and open it in your chosen editor.

- In the top section of Form 6198, enter the names shown on your tax return. Make sure this matches your tax documents to ensure consistency.

- Proceed to Part I, where you will report the current year profit or loss from the activity. Fill in the ordinary income or loss from the activity on line 1, being mindful of the instructions.

- For lines 2a through 2c, record any gain or loss from the sale or other disposition of assets used in the activity, ensuring to refer to the appropriate schedule as instructed.

- On line 3, include any other income or gains from the activity not captured in prior lines, and enter the relevant details from Schedule K-1.

- Complete line 4 by listing other deductions and losses from the activity, including any investment interest expense allowed.

- Calculate and enter the current year profit or loss on line 5 by combining all amounts from lines 1 to 4. This total will guide you in filling out the rest of the form.

- Moving to Part II, begin with line 6, which requires the adjusted basis in the activity. Ensure this reflects the minimum amount of zero or greater.

- In line 7, report any increases for the tax year as per the provided instructions. Add this to your adjusted basis in line 6 on line 8.

- Complete line 9 with the applicable decreases for the year, then subtract this from the total in line 8 on line 10a.

- If the result on line 10a is greater than zero, transfer the amount to line 20. If not, follow the guidance provided in Publication 925.

- Advance to Part III to provide a more detailed computation, including investments and adjustments as outlined in the instructions.

- Lastly, ensure all calculations are correct and save changes or download the completed form. You may also choose to print or share the form as needed.

Complete your IRS Form 6198 online today for accurate reporting of your at-risk limitations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.