Loading

Get Irs 9465(sp) 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 9465(SP) online

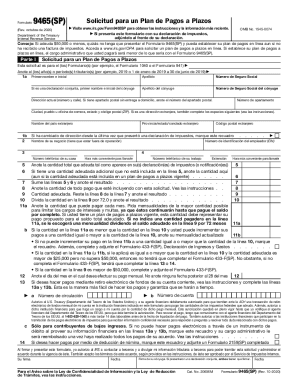

Filling out the IRS 9465(SP) online is a crucial step for anyone seeking to establish a payment plan for their tax liabilities. This guide will provide you with comprehensive, step-by-step instructions tailored for users with various levels of experience.

Follow the steps to complete your IRS 9465(SP) online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, begin by specifying the years or periods for which you owe taxes, and provide your personal information including your first name, last name, and social security number. If you are filing jointly, include your partner's information as well.

- Fill in your current address. If you have a post office box, make sure to specify that. Additionally, indicate if you have changed your address since your last tax return.

- Provide your employer identification number (EIN) if applicable, and include your contact numbers along with the best times to reach you.

- Indicate the total amount owed as reflected in your tax filings or notifications. If there are any additional amounts owed, list those as well.

- Calculate the total amount due by summing the amounts in lines 5 and 6. This is important as it determines your monthly payment amount.

- On line 8, enter any payment you are including with your application. Then, subtract this amount from the total in line 7 to find your balance owed on line 9.

- Calculate your proposed monthly payment. Divide the amount in line 9 by 72 to determine your minimum monthly payment.

- Fill in line 11a with the maximum monthly payment you can afford to pay. If your payment on line 11b is less than the amount in line 10, evaluate whether you can increase it.

- If you wish to make payments electronically, complete the necessary lines for direct debit, providing your account details.

- Sign the form, ensuring all necessary parties sign if filing jointly. Make sure to date your signature as well.

- If applicable, complete Part II of the form based on the specified criteria, adding additional personal and financial information as required.

- Once all sections are completed, review the form for accuracy and save your changes. You can then choose to download, print, or share the document based on your needs.

Start filling out your IRS 9465(SP) online today to take control of your tax liabilities.

The Internal Revenue Service (IRS) allows taxpayers to pay off tax debt through an installment agreement. ... If paying the entire tax debt all at once is not possible, an installment agreement is an alternative allowed by the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.