Loading

Get Sc Sc1041es_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC SC1041ES_DSA online

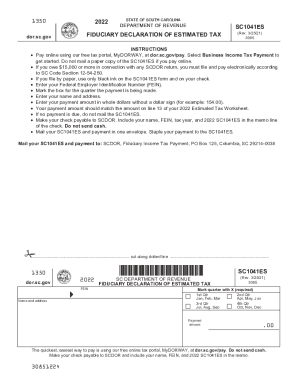

Filling out the SC SC1041ES_DSA form is an essential part of the fiduciary tax process in South Carolina. This guide will provide a straightforward approach to effectively complete the form online, helping you to meet your tax obligations with clarity and ease.

Follow the steps to successfully complete your SC SC1041ES_DSA form online.

- Click ‘Get Form’ button to access the SC SC1041ES_DSA form and open it for completion.

- Enter your Federal Employer Identification Number (FEIN) in the designated field. This number is crucial for identifying your tax records.

- Select the quarter for which the payment is being made by marking the appropriate box. Ensure to choose from the following options: 1st Qtr, 2nd Qtr, 3rd Qtr, or 4th Qtr.

- Fill in your name and address accurately. Providing correct information is essential for proper processing.

- Enter the payment amount in whole dollars without including a dollar sign. This amount should match the figure found on line 13 of your 2022 Estimated Tax Worksheet.

- Review all entered information for accuracy, as incorrect details can lead to processing delays.

- Save your changes, and if applicable, download, print, or share your completed form as required.

Complete your SC SC1041ES_DSA form online today to ensure timely filing and payment.

Related links form

South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.43 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.