Loading

Get Sc Dor Sc1120s 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120S online

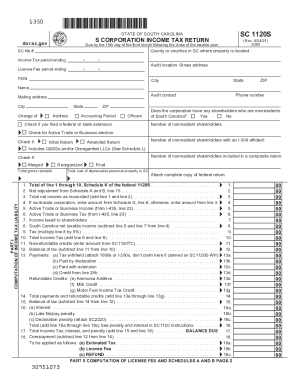

Filling out the SC DoR SC1120S form can be a straightforward process if you have the right guidance. This guide will walk you through each section of the form, ensuring that you understand what information is needed to complete it correctly and efficiently.

Follow the steps to effectively complete the SC DoR SC1120S form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Indicate the county or counties in South Carolina where your property is located by entering the respective information in the designated fields.

- Enter your South Carolina file number and the income tax period ending date in the appropriate fields.

- Provide your Federal Employer Identification Number (FEIN) along with the complete mailing address, including city, state, and ZIP code.

- If applicable, check the box indicating whether you filed a federal or state extension and provide the required contact information for your audit.

- Indicate if there are any nonresident shareholders by checking ‘Yes’ or ‘No’, and specify the number of nonresident shareholders if applicable.

- Fill in the appropriate section for the computation of income tax liability, ensuring to carefully enter figures on total gross receipts and other necessary income-related data.

- After completing the form, review each section for accuracy and completeness, then proceed to save your changes.

- Finally, download, print, or share the form as needed, following the requirements for submission.

Complete your SC DoR SC1120S form online today for a hassle-free filing experience.

Differences Between Form 1120 and 1120-S Form 1120-S is filed by S Corps for federal taxes, while Form 1120 is filed by C Corps for taxes. S Corps and C Corps are both classified as corporations; however, they have several differences and offer different advantages and disadvantages to business owners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.