Loading

Get Sc Dor Sc4868 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC4868 online

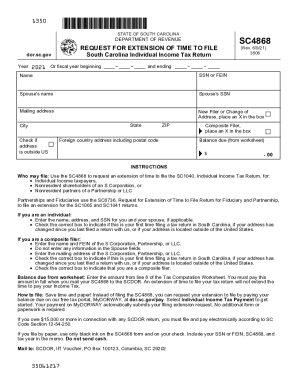

This guide provides clear and detailed instructions for completing the SC DoR SC4868 form, which is essential for requesting an extension of time to file your South Carolina Individual Income Tax Return. Whether you are an individual taxpayer or a composite filer, the following steps will help ensure that you fill out the form accurately and efficiently.

Follow the steps to complete the SC DoR SC4868 form online.

- Click the ‘Get Form’ button to obtain the SC DoR SC4868 form and open it in your preferred online editor.

- Fill in the year for which you are requesting an extension. If you are requesting an extension for a fiscal year, provide the starting and ending dates.

- Enter your full name and Social Security Number (SSN). If applicable, provide your spouse's name and SSN as well.

- Input your mailing address, including state, city, and ZIP code. If your address has changed since your last filing, check the corresponding box.

- For those filing for the first time in South Carolina or if your address is outside the United States, mark the appropriate boxes.

- If you are a composite filer, enter the name and Federal Employer Identification Number (FEIN) of the S Corporation, Partnership, or LLC. Ensure not to fill in the spouse's fields.

- Indicate if you are a composite filer by checking the relevant box.

- Calculate the balance due using the Tax Computation Worksheet, adding any expected Income Tax and Use Tax due, and entering the total on line 8.

- After completing all sections, save any changes made to your form, and you may download, print, or share the completed SC DoR SC4868 form as needed.

Complete your tax documents online for a smoother filing experience.

Before you complete this form, check your refund status at dor.sc.gov/refund or call us toll free at 1-844-898-8542. Allow 30 days from the issued date of your refund before you submit this form. For faster results, report a missing refund on our free tax portal at MyDORWAY.dor.sc.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.