Loading

Get Md Form 502s 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 502S online

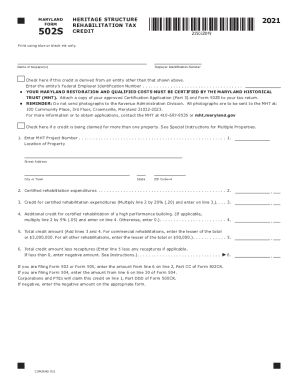

The MD Form 502S is used to claim tax credits for the rehabilitation of certified historic structures in Maryland. This guide provides clear and supportive instructions for filling out the form online, ensuring that all required details are accurately completed.

Follow the steps to fill out the MD Form 502S online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the taxpayer or taxpayers in the designated field.

- Input the Taxpayer Identification Number (TIN) in the next field.

- If the tax credit is derived from an entity, check the corresponding box and enter the entity’s Federal Employer Identification Number.

- Enter the Maryland Historical Trust (MHT) Project Number and the location details including street address, city or town, state, and ZIP code.

- Input the total certified rehabilitation expenditures in the space provided.

- Calculate the credit for certified rehabilitation expenditures by multiplying the amount from the previous step by 20% and enter the result.

- If applicable, calculate the additional credit for high performance buildings by multiplying the certified expenditures by 5% and input the result. If not applicable, simply enter 0.

- Add the credit amounts from the previous two steps to get the total credit amount, entering the lesser of that total or the applicable maximum credit.

- Finally, calculate the total credit amount less any recaptures (if applicable) and enter this figure.

- Save the changes you have made, and options will be available to download, print, or share the completed form.

Complete your MD Form 502S online today to take full advantage of the available tax credits.

What are the tax rates? If the PTE has entity members, it calculates its PTE tax at the Maryland corporate income tax rate (8.25% for the 2021 tax year). For individual members, the electing PTE must pay tax at the highest marginal state income tax rate, plus the lowest county tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.