Loading

Get Md Form 502v 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 502V online

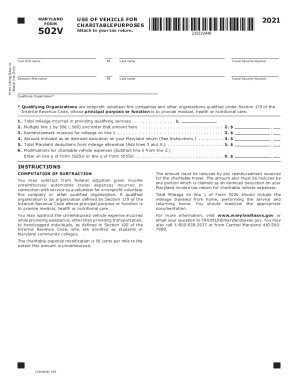

Filling out the MD Form 502V is essential for reporting vehicle usage for charitable purposes on your tax return. This guide will assist you in completing the form online while ensuring accuracy and compliance.

Follow the steps to fill out the MD Form 502V accurately.

- Click ‘Get Form’ button to access the MD Form 502V and open it in your preferred online form editor.

- Enter your first name, middle initial, and last name in the designated fields, followed by your Social Security Number.

- Repeat the previous step for your spouse’s name and Social Security Number, if applicable.

- In the ‘Qualifying Organization’ field, provide the name of the nonprofit organization with which you volunteer.

- Input the total mileage incurred while providing qualifying services in line 1.

- Multiply the total mileage reported in line 1 by 56 cents and enter the amount in line 2.

- If you have received reimbursement for mileage, enter that amount in line 3.

- For line 4, specify the amount included as an itemized deduction on your Maryland return for charitable vehicle expenses.

- Add the amounts from lines 3 and 4, and place the total in line 5.

- Subtract line 5 from line 2 to determine the modifications for charitable vehicle expenses and enter that amount in line 6.

- Finally, you can save changes, download, print, or share the completed form as necessary.

Complete your tax documentation online with confidence!

FORM. 502. RESIDENT INCOME. TAX RETURN. Print Using Blue or Black Ink Only.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.