Loading

Get Md El101 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD EL101 online

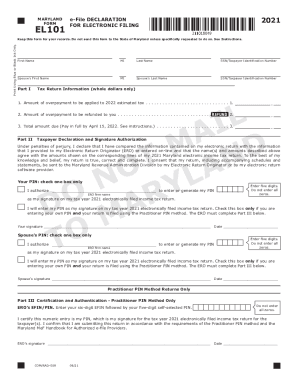

Filling out the MD EL101 form is an essential step for taxpayers using the electronic filing option for their income tax returns. This guide will walk you through each section of the form, providing clear instructions to ensure a smooth completion process.

Follow the steps to successfully complete the MD EL101 form.

- Press the 'Get Form' button to access the MD EL101 form and open it in an online form editor.

- Begin by entering your first name, middle initial, and last name in the designated fields at the top of the form. Ensure accuracy to avoid any delays in processing.

- Input your Social Security Number or Taxpayer Identification Number in the specified area. Double-check for any errors.

- Provide your spouse's first name, middle initial, and last name, along with their Social Security Number or Taxpayer Identification Number, if applicable.

- In Part I, enter the amount of overpayment to be allocated to your 2022 estimated tax in whole dollars. Use line 1 for this entry.

- On line 2, state the amount of overpayment that you wish to receive as a refund.

- Complete line 3 by indicating the total amount due to ensure timely payment by the due date.

- Proceed to Part II and read the declaration carefully. Confirm that the information is accurate. You will provide your e-file PIN here, choosing between authorizing the ERO to enter it or entering it yourself.

- If authorizing the ERO, check the appropriate box and input their firm name along with your five-digit PIN. If entering it yourself, check the relevant box.

- Sign and date the form in the areas provided to complete your declaration.

- If applicable, repeat the steps in Part II for your spouse, including their PIN and signature.

- For EROs using the Practitioner PIN method, complete Part III with the required numeric entries for certification.

- Once all parts are completed, save your changes. You may download, print, or share the form as needed, ensuring you keep a copy for your records.

Get started on completing your MD EL101 form online today!

Form EL101 is the declaration document and signature. authorization for an electronically filed return by an Electronic. Return Originator (ERO). Complete Form EL101 when the. Practitioner PIN method is used or when the taxpayer authorizes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.