Loading

Get Nc D-407 Nc K-1_dsa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC D-407 NC K-1_DSA online

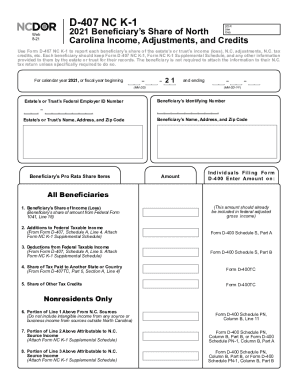

The NC D-407 NC K-1_DSA form is essential for reporting each beneficiary's share of income, adjustments, and tax credits from an estate or trust. This guide will provide clear and detailed instructions on filling out the form online, ensuring users can navigate the process with confidence.

Follow the steps to complete your NC D-407 NC K-1_DSA online

- Click the 'Get Form' button to access the NC D-407 NC K-1_DSA form and open it in your preferred editor.

- Begin by filling out the beneficiary’s name, address, and zip code in the designated fields. Ensure accuracy as this information is essential for tax reporting.

- Next, enter the estate’s or trust’s Federal Employer ID Number, along with the name, address, and zip code of the estate or trust. This identifies the entity for tax purposes.

- Record the beneficiary’s identifying number. This number is important for linking the beneficiary to the income reported.

- Proceed to complete the income items by detailing the beneficiary’s share of income or loss. This should be entered from the relevant Federal Form 1041, specifically Line 18.

- In the subsequent sections, fill in the deductions and other credits provided in the supplemental schedules as instructed, making sure to adhere to the guidelines about non-resident income and adjustments.

- Review all entered information for accuracy. It is essential to ensure that no dollar signs, commas, or other punctuation marks are used, as per form guidelines.

- Once you have completed and reviewed the form, save your changes. You may download, print, or share the completed form as required for your records or for submission.

Start filling out your NC D-407 NC K-1_DSA online today to ensure accurate reporting of estate or trust income.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Capital gains are almost always taxed to the trust, even if they are distributed to a beneficiary. There are seven states with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.