Loading

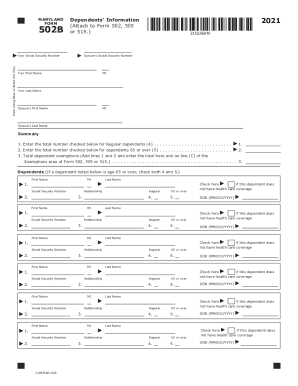

Get Md Comptroller 502b 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502B online

Filling out the MD Comptroller 502B form online is a straightforward process that can help you report your dependents' information efficiently. This guide will provide you with clear, step-by-step instructions tailored for users of all experience levels.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Social Security number in the designated field. Ensure to use blue or black ink if printing.

- Enter your first name, middle initial, and last name in the respective fields.

- Provide your spouse's Social Security number, first name, middle initial, and last name, if applicable.

- In the summary section, enter the total number of regular dependents and dependents aged 65 or over in the specified fields.

- Add the totals from the previous step to find the total dependent exemptions, and record this number in the total exemptions area.

- List each dependent's first name, last name, Social Security number, relationship, and check the appropriate boxes for regular dependents and those aged 65 or over.

- For each dependent, indicate if they do not have healthcare coverage by checking the relevant box.

- Review all the information entered to ensure it is accurate and complete.

- Once you are satisfied with the information, proceed to save changes, download, print, or share the form as necessary.

Complete your documents online with confidence today!

redemption cannot be filed until six months after the date of sale (nine months in Baltimore City), and it cannot be filed later than two years after the date of the certificate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.