Loading

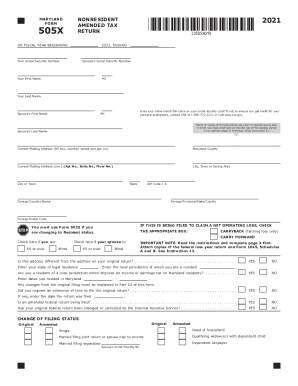

Get Md Comptroller 505x 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 505X online

This guide provides a clear and comprehensive walkthrough for users looking to complete the MD Comptroller 505X form online. Whether you're filing an amended nonresident tax return or simply need assistance with the various sections of the form, this guide is designed to support you throughout the process.

Follow the steps to successfully complete your MD Comptroller 505X form.

- Click ‘Get Form’ button to obtain the MD Comptroller 505X online form and open it in the provided editor.

- Begin by entering your tax year information in the designated fields at the top of the form. Specify the beginning and ending dates of the fiscal year you are reporting.

- Input your Social Security Number in the designated field, as well as your spouse's Social Security Number if applicable.

- Fill in your personal details including your first name, middle initial, and last name.

- Indicate whether your name matches the one on your Social Security card. If there is a discrepancy, note the guidance to contact the Social Security Administration.

- Provide your current mailing address, making sure to include all necessary details such as street address, apartment number, city, state, and ZIP code.

- If applicable, indicate if you are filing to claim a net operating loss, and mark whether you qualify based on your age or other criteria.

- Fill in information regarding your local jurisdiction and the dates you resided in Maryland.

- Input your income details as indicated on the form, including wages, salaries, and any adjustments to income from your federal return.

- Complete the itemized deductions section if it applies to you, providing relevant figures from your federal tax return.

- If there were any changes from your original filing, explain them in Part III of the form.

- Review the entirety of the form for accuracy and completeness, ensuring all required fields are filled out properly.

- Once completed, save your changes, and you can choose to download, print, or share the form online.

Complete your MD Comptroller 505X form online today for a smooth filing experience.

California law requires business entities that prepare an original or amended return using tax preparation software to electronically file (e-file) their return with us.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.